Entering Third-Party Payroll in QuickBooks

Many businesses use QuickBooks for accounting but do not use QuickBooks as their payroll provider. Here is how to enter payroll properly in QuickBooks when using a third-party payroll provider.

Simple Situation

Find Report

In your payroll portal find the report called something like “Payroll Summary” or “Payroll Journal” that shows total wages, deductions, employee and employer taxes and net pay amounts.

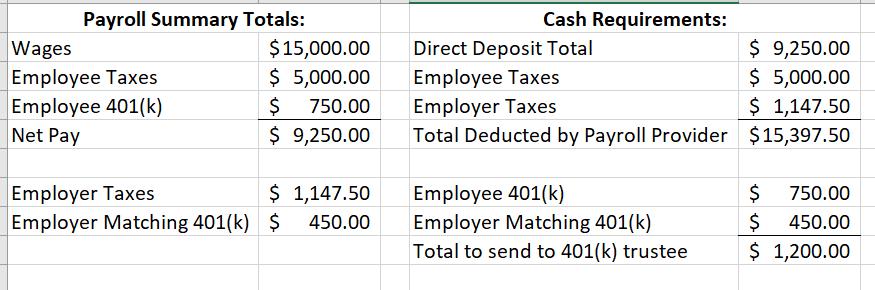

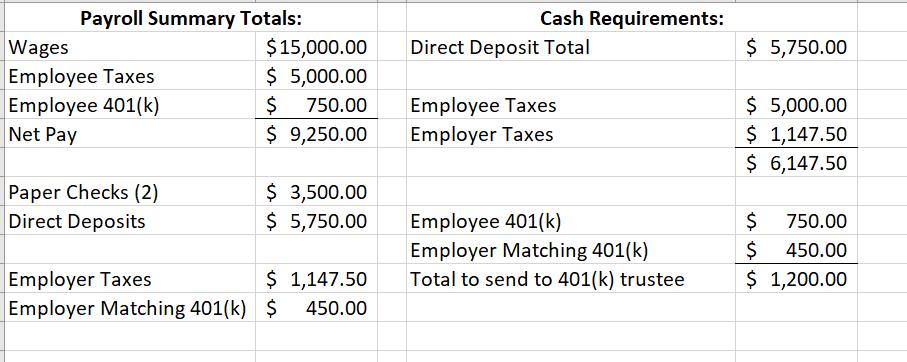

In the first example all individual paychecks are direct deposited and the payroll provider deducts everything in one transaction. This is the simplest format. The company also has employee 401(k) deductions and employer matching contributions that the payroll company does not remit. The company is responsible for remitting 401(k) contributions. The report looks something like this:

Enter QuickBooks Transaction

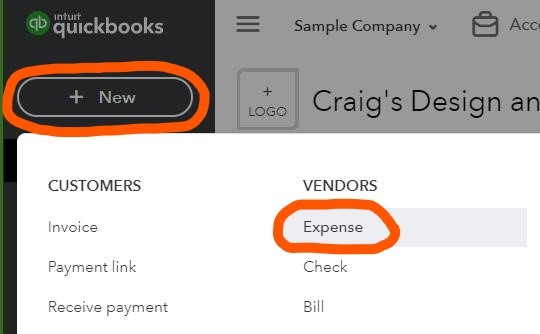

To enter this pay in QuickBooks we are going to use an expense transaction. Click on + New / Expense:

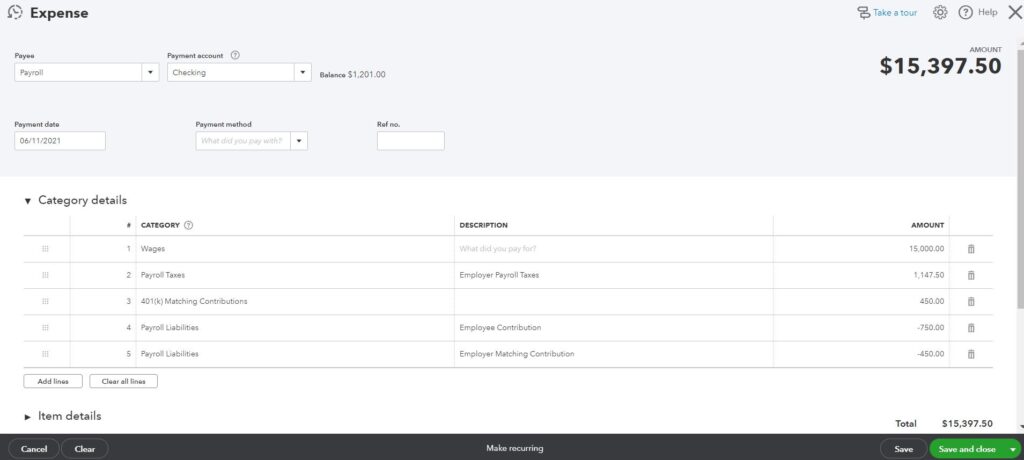

The expense transaction will look like this:

The first three accounts are expense accounts in your chart of accounts. The Payroll Liabilities account is a current liability in your chart of accounts.

Click save and close and your payroll entry is done. You still need to remit the $1,200 total employee and employer 401(k) contributions though. To do that create a check or submit the payment electronically to your 401(k) trustee. Create the QuickBooks check or expense using the “Payroll Liabilities” account. Your Payroll Liabilities account should now be zero.

More Complex Situations

Some payroll providers withdraw multiple transactions for a pay. In this example the total direct deposits is a withdrawal and the combined employee and employer payroll taxes is a separate withdrawal. There are also a few paper checks along with direct deposits.

The payroll summary report looks like this:

Create Clearing Account

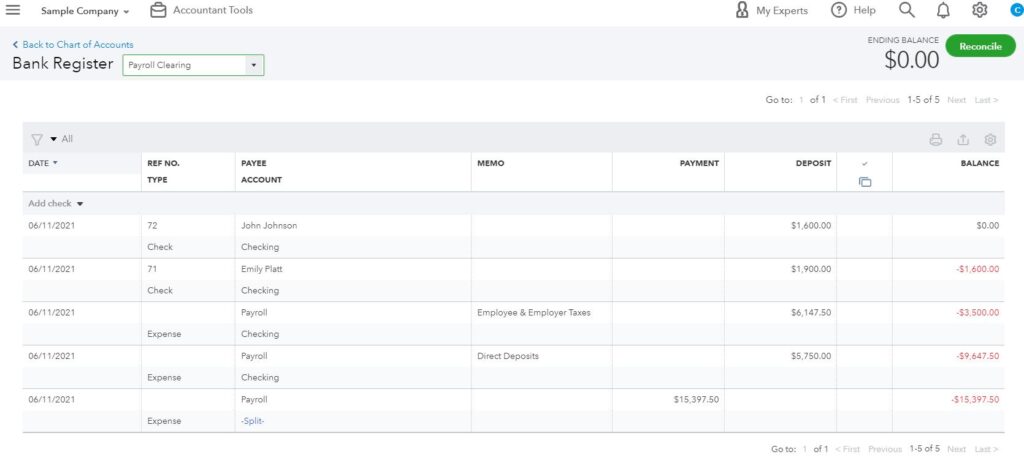

We are going to create a new bank account called “Payroll Clearing.” The expense entry will be the same as in the first example but instead of having the expense come out of the regular checking account we will create the expense out of the Payroll Clearing account.

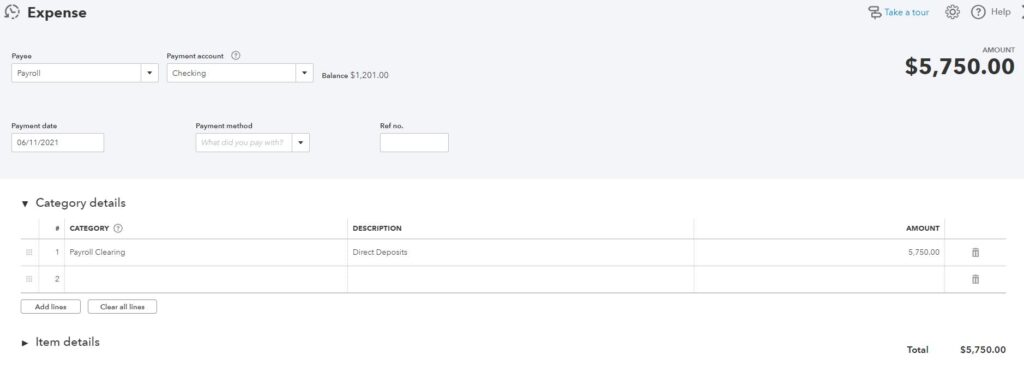

So at this point our payroll clearing account has a negative balance of $15,397.50. Create the two withdrawals the payroll provider will make. The first will be the direct deposit total of $5,750. So that will be an expense out of your checking account at the top and use the Payroll Clearing account on the line item like this:

Do the same thing with the payroll provider withdrawal consisting of total employee and employer taxes of $6,147.50. This still leaves a negative balance of $3,500 in our payroll clearing account which is the amount of the paper checks. Create the two paper checks the same way as the payroll provider withdrawals. And now your payroll clearing account is zero.

Conclusion

The above examples are the proper way to enter third party payroll into QuickBooks.